The US recorded music market expanded slightly in the first half of 2024, but not significantly.

The retail value of overall industry revenue hit $8.65 billion, according to RIAA numbers released Thursday (Aug. 29), owing primarily to a minor increase in streaming revenue and a rise in vinyl sales.

While the income for the first half of the year was a record, it represented only a 3.9% increase over the previous year’s period. The U.S. market has resumed a more workmanlike pace, with high-single-digit and double-digit gains in the rearview mirror. In comparison, revenue increased 8.8% and 9.0% in the first half of 2022 and 2023, respectively. Revenue increased by 27.0% in the first half of 2021, as pandemic-era lockdowns drove people to their gadgets, boosting paid and ad-supported streaming.

READ MORE: Latin Music Generated $627 Million In US Recorded Music Revenues In H1 2023, A 14.8% Increase

Vinyl EP and LP sales increased by 10.7% to 24.3 million units, with a value of $739.9 million, up 17%. Other physical formats gained popularity, but the gap between them and vinyl widened. CD sales rose barely 0.3% to $236.7 million. The other category, which includes cassettes, CD singles, vinyl singles, DVD audio, and SACD, increased 66.6% to $13.2 million.

Physical sales accounted for 11.4% of total income, up from 10.5% the previous year and 10.2% in the first half of 2022. Vinyl’s market share has doubled in five years, accounting for 8.5% of total U.S. revenue, up from 4.2% in the first half of 2020.

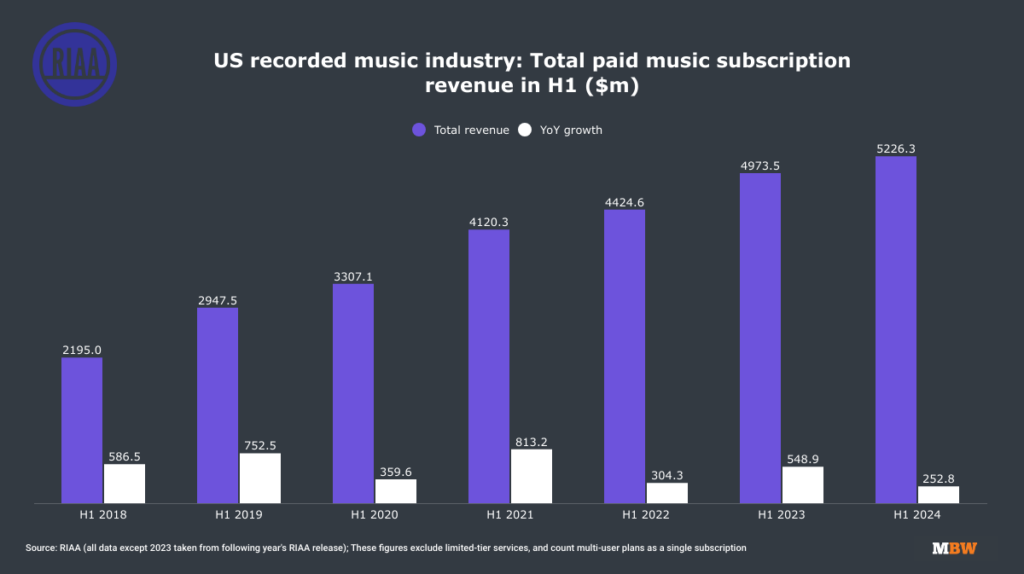

Streaming continues to dominate industry income, accounting for the single largest dollar rise across all categories. Total streaming revenue increased by 3.8% to $7.3 billion, accounting for 84.1% of total revenue, the same as in the previous year. Paid subscription income rose 5.1% to $5.23 billion, well above all other streaming categories. The average number of members hit 99 million, up only 2.6%, indicating that record companies benefited from Spotify and other services’ pricing rises.

READ MORE: In 2022, Global Recorded Music Revenues Reached $31.2BN, But YOY Growth Slowed ‘Significantly’

Other streaming segments had a lower impact or lost ground in the previous year. Limited-tier paid subscriber sales fell 4.1%, to $503 million. (Limited-tier services offer smaller libraries, fewer interactive options, and other features that differ from premium subscription plans. Ad-supported on-demand income increased 2.5% to $899 million. SoundExchange dividends totaled $517 million, up 3.9%. Other ad-supported streaming (statutory streaming services not provided by SoundExchange) decreased 2.7% to $159.1 million.

Download sales, once the cornerstone of the US market, fell for the 14th consecutive year, accounting for only 2% of industry income. Total download sales decreased 15.8% to $189.7 million. Track and digital album sales dropped 16.1% and 18.5%, respectively. Ringtones and ringbacks fell 51.1% to $2.9 million. The other digital category, which includes kiosks and music video downloads, increased 22.0% to $17.1 million.

Synchronization royalties fell 9.8% to $200.9 million, contrasting with significant rises of 25.3% and 29.9% in the first half of 2022 and 2023, respectively.

In a statement, RIAA chairman/CEO Mitch Glazier emphasized the music ecosystem’s evolution and the record-breaking income of $8.7 million. “Spanning multiple licensing avenues from fitness apps to short-form video, artists and labels are embracing innovation with responsible partners so more Americans can engage with their favorite music however, whenever and wherever they choose,” his statement reads. “This sustained growth fuels innovation and reflects music’s incredible value, laying the foundation for a healthy creative ecosystem where artists’ and songwriters’ visions can flourish over generations.”

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.