Step aside, advertising-focused websites. Another media quality debate has erupted in the realm of online video.

The buy-side is becoming increasingly concerned with how publishers categorize their video content.

The Trade Desk sparked a reckoning when it terminated support for Yahoo video inventory, which it claims the publisher mislabeled as instream.

Now, the industry is wondering how much mislabeled video inventory is flowing in open auctions.

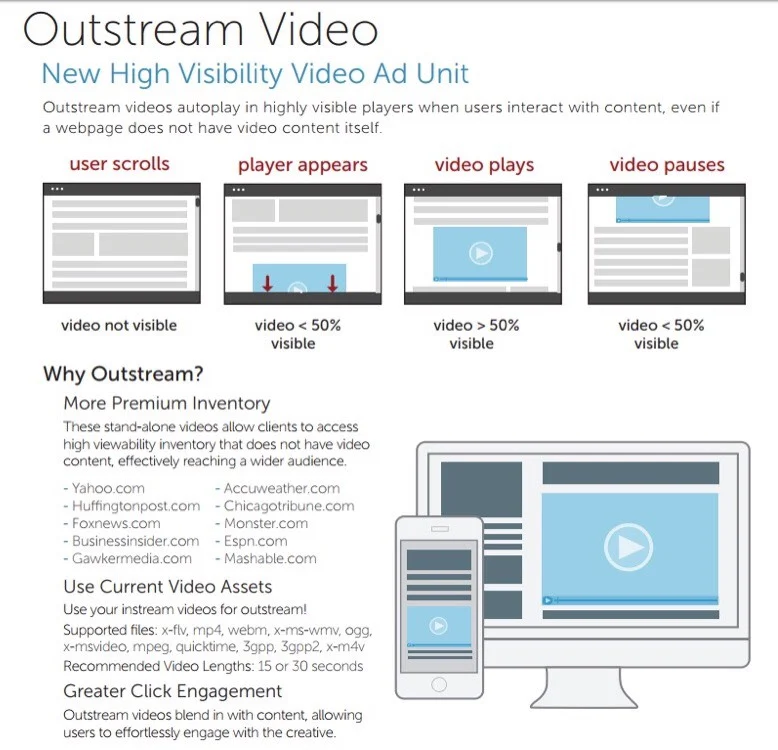

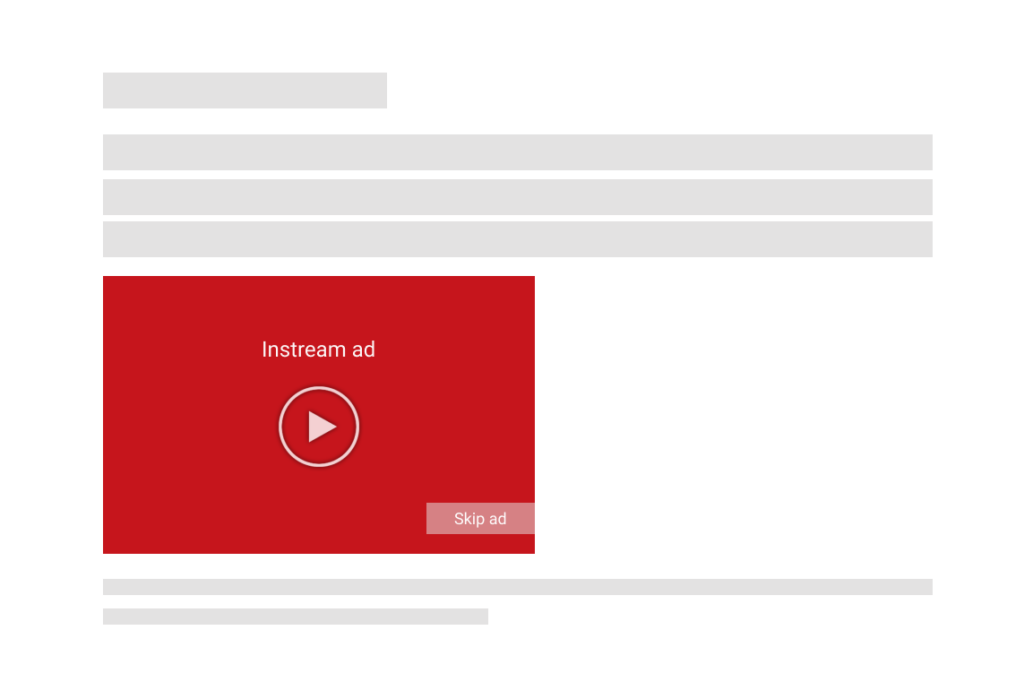

Instream video, loosely defined, is video that the viewer expects to see when they arrive on the website and plays with sound turned on. Outstream includes anything that does not meet the standards for instream, such as floating video players with muted auto-play content.

“Outstream video is just a moving banner ad, and it has become this terrible experience that annoys consumers,” said Scott Konopasek, a media expert at Pant Rhei Consulting.

Unfortunately, there is more outstream video inventory in open auction than instream, which is causing labeling issues.

For example, one common indicator of instream video is the sound playing by default. However, buy-side sources told AdExchanger that only 5% of open-auction video inventory is non-muted. The most generous estimate put non-muted footage at 15%.

READ MORE: 3 Lessons IT Leaders Can Learn From Astronauts About Digital Transformation

This limited instream inventory is frequently packaged by publishers and SSPs with less desirable outstream placements, such as muted floating video players. This packaging raises outstream video prices while potentially lowering instream video prices, affecting both advertisers looking for premium placements and publishers that sell the good stuff.

Many industry professionals informed AdExchanger that most publishers and SSPs are not motivated to appropriately label their inventory. However, they believe that rising pressure from significant buy-side companies such as The Trade Desk would address the skewed pricing dynamics caused by outstream being marketed as instream.

Marketers like instream video because it is the closest internet video can come to mimicking the TV ad experience. According to the IAB Tech Lab’s video standards, instream video playback must be initiated by the user, sound must be enabled by default, and the user must visit the page expecting to see video content.

Dave Morgan, creator and executive chairman of TV ad platform Simulmedia, believes that an instream media environment is considerably more favorable to capturing an audience’s complete attention than outstream.

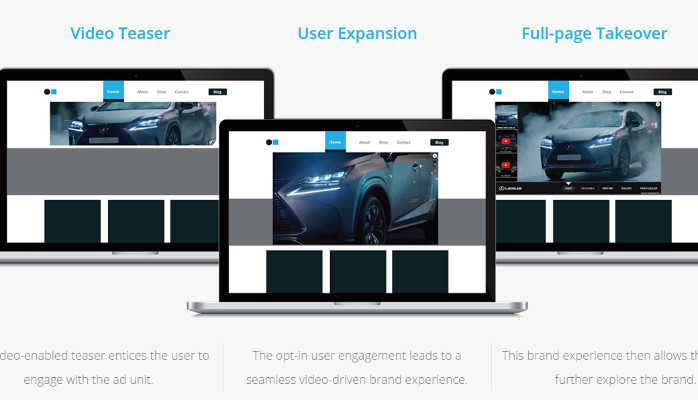

When marketers think about instream, they see YouTube. When people think about outstream, they envision muted floating video players that bother viewers as they scroll down the website.

“When I’m buying video, I want people to be able to hear the audio,” he said, “and I don’t want it to be banished to some small corner of the page.”

Selling, purchasing, and labeling video inventory

The problem is that publishers and SSPs are responsible for labeling the video inventory they sell by filling out sections in OpenRTB bid submissions.

And, despite the fact that the IAB Tech Lab released updated standards for what sorts of content can be designated as instream more than a year ago, some publishers are still not following them. They continue to mislabel outstream placements as instream because the latter generally fetches CPMs of $15 or more, but outstream generates CPMs in the single digits.

In April, the Media Rating Council began recommending measurement providers to treat purposeful mislabeling of outstream inventory as invalid traffic.

Buyers can now request a refund for such placements under new standards, according to Erez Levin, principal of Emet Advisory and a 13-year Google veteran.

Meanwhile, SSPs integrate outstream impressions alongside instream impressions to assist agencies meet vanity metrics for video buys like video completion rate and viewability. Buyers notice higher ROAS when cheaper impressions are mixed throughout, which helps SSPs retain customers.

As a result, many publishers and SSPs will continue to charge higher pricing for mislabeled goods for as long as possible.

Meanwhile, many web publishers that sell instream video also sell outstream video, so it’s unlikely that they’d take aggressive actions to reduce the value of their outstream inventory to benefit their smaller supply of instream.

Furthermore, purchasers sometimes have no idea what they’re bidding on until after they’ve purchased it.

According to Rocky Moss, co-founder and CEO of DeepSee.io, log-level data can disclose several proxy signals for whether a video is instream, such as whether the sound was turned on, the size of the video player and its position on the page, or the device used to watch the video. However, purchasers rarely view such reporting before bidding.

According to Moss, DSPs such as The Trade Desk allow you to bid on impressions only when the video plays with sound, when the player is a specified size, or when the impression is provided on a specific device. However, he pointed out that this will not assist purchasers in determining whether the video content matches the reason a person arrived to the page, which is another need for instream placements.

Moss suggested that ad verification suppliers such as IAS and DoubleVerify could do more to ensure that video inventory is appropriately tagged before a bid is made.

However, he stressed that the mislabeling problem cannot be solved only by verification technology. The problem remains because sell-side incentives to generate more money exist, and marketers value vanity metrics that video platforms can readily rig.

Direct and selected deals.

So, Morgan remarked, “the best way to make sure that you don’t get garbage is to do direct deals.”

After all, one of the reasons there is so little instream inventory available in open auction is that it is sold directly or, in the case of CTV, during upfronts.

“Whether those are PMPs or PG deals, the industry is increasingly going to insertion order deals that use programmatic pipes to deliver,” according to Morgan. “The Trade Desk is talking about an always-on upfront akin to a futures market, and I think that’s where we’re heading.”

DSPs might potentially become more involved in packaging curated pools of trusted publishers whose inventory fits instream requirements, and there are already plans to do so.

DeepSee, for example, recently worked with a client that used sound-on as a proxy to purchase instream video, and it explored purchasing the same publisher domains via The Trade Desk’s SP500+ offering as well as open programmatic.

“The audio-on rate was much [higher] for the Top 500 slice, probably because it’s ad-unit-level targeting,” Moss told me. “Ad-unit targeting is key, because even on the same site, in the same section, you may find that certain articles are instream and certain articles are not.”

And, as the Yahoo instance indicates, The Trade Desk isn’t afraid to call out those who fail to meet media quality requirements, according to Levin. The firm’s “message to big publishers and SSPs will be, ‘Clean this up and take the revenue hit, or we’ll make sure you take a revenue hit and a reputational hit.'”

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.