Streaming, in addition to sports, was the primary focus of the recent TV upfront season.

Upfront presentations were markedly different just a few years ago; Netflix and Disney+, for instance, did not even provide ad-supported plans until late 2022. However, priorities have evolved. Advertising is increasingly becoming a significant component of the streaming industry in order to diversify revenue and prioritize profitability over subscriber growth.

This rapid transformation is reflected in the latest data from Antenna. 51.4 million of the 71.8 million net new U.S. streaming subscriptions were to ad-supported tiers between Q1 of 2023 and Q1 of 2025.

READ MORE: In May, Streaming Surpasses Broadcast/Cable For The First Time

That is an astonishing 71%.

Data summary: Ad-supported programs comprise 46% of all SVOD subscriptions in the United States as of March 2025.

In Q1, 65% of ad-supported subscriptions were new users, 23% were “win backs,” or those who canceled a service and resubscribed, and 11% were “traders,” meaning those who were initially on an ad-free plan and subsequently converted to an ad-supported plan.

READ MORE: Disney Will Spend Over $439 Million To Fully Acquire Hulu, A Streaming Service

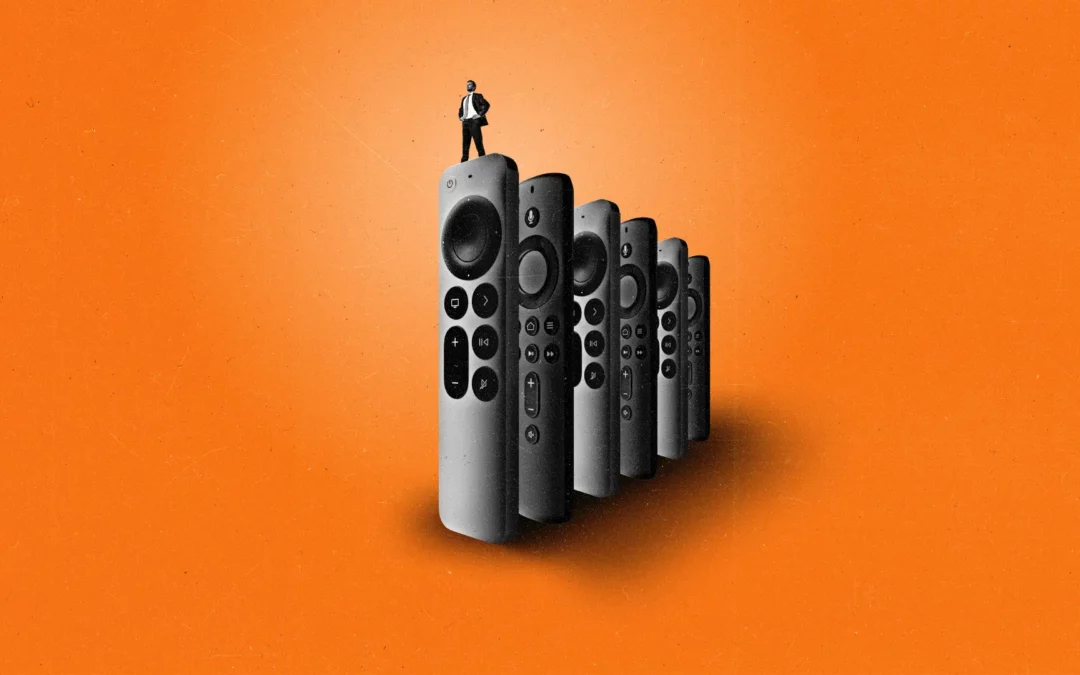

Discovery+, Disney+, Hulu, Max, Netflix, Paramount+, and Peacock comprised the data. It is worth noting that Amazon Prime Video is not included, as it instituted its ad tier as the default option for subscribers last year.

Why it matters: Advertising could become an even more prominent focus for SVOD platforms as traditional linear TV experiences difficulties. The momentum demonstrated in Antenna’s report is a positive indicator that consumers are at ease with advertisements in exchange for reduced prices.

Ali Erkurt, a senior product manager at Starz, posted on LinkedIn, “The ad-supported era of streaming is here, and it is thriving.” “Ads are not a compromise.” They are a viable alternative, and they are becoming increasingly the preferred option.

Step into the ultimate entertainment experience with Radii+ ! Movies, TV series, exclusive interviews, live events, music, and more—stream anytime, anywhere. Download now on various devices including iPhone, Android, smart TVs, Apple TV, Fire Stick, and more!