SSPs are coming for streaming media.

According to Jounce Media, the average CTV platform now enables 30 SSPs to sell its programming, more than double the amount of SSPs used by streamers last year.

SSPs are turning CTV inventory into curated, multichannel promotions. However, occasionally the CTV inventory is linked to less appealing material or has been resold by other SSPs. This raises doubts about whether buyers are getting what they paid for.

And make no mistake: customers are paying a lot. One of the most visible results of growing SSP saturation has been higher costs as a result of SSPs reselling inventory, according to Jounce Media founder Chris Kane, who spoke at the IAB Tech Lab’s 10th anniversary summit last week.

READ MORE: Monetization Models In Digital Broadcasting: YouTube Versus Professional CTV Platforms

Auctions run directly by platforms that possess the rights to the CTV content being sold have a median CPM floor of $14. The median for reseller-operated auctions, however, is $19.50. According to the Jounce presentation, buying through an SSP reseller results in an average price increase of 39%.

A more complicated CTV market.

Some CTV platforms are gaining SSP partners at a rapid pace. This has increased the amount of feasible supply lines to the same inventory.

READ MORE: CTV And FAST Channels: Their Strategic Role In Digital Advertising

Take Paramount-owned Pluto TV, which is one of the more active streaming providers in terms of SSP relationships. Pluto authorized the sale of its stockpile to four SSPs in the beginning of 2020. According to Jounce’s research, that number is now about 67.

Buying CTV is now almost as complicated as buying display impressions, which has significantly more SSP participation. However, the additional complexity in CTV is primarily limited to cross-publisher programmatic auction packages selected by SSPs, rather than direct transactions.

“Several years ago, there would have been only two SSPs you could buy CTV from,” Kane stated during the presentation. “That might [still] be the case for one-to-one deals, but not for auction packages.”

Until recently, Kane said, most CTV commercials were purchased directly through single-seller agreements. These could be activated as part of a programmatic guaranteed or private marketplace agreement.

READ MORE: Metrics And Measurement: The Data Behind CTV Integration With Digital Media

In most cases, the sole vendor is a TV manufacturer that runs a streaming platform, an independent app developer, or the media owner of the streaming content.

Let’s pretend AMC owns the media. Because its content is streamed on different CTV apps, the advertiser may bid on advertising across multiple channels.

Kane explained that such direct relationships provide purchasers with greater transparency into ad inventory and cost. However, they do not scale successfully, therefore purchasers supplement those transactions with other goods, which is often purchased through an open exchange.

Still, “as an industry, we effectively freaked out buyers about the risks of open auction for connected TV,” Kane told me. “We told buyers that there are shenanigans that we’re still too immature as an industry to be able to detect as robustly as we do on the web, so watch out in the CTV open market.”

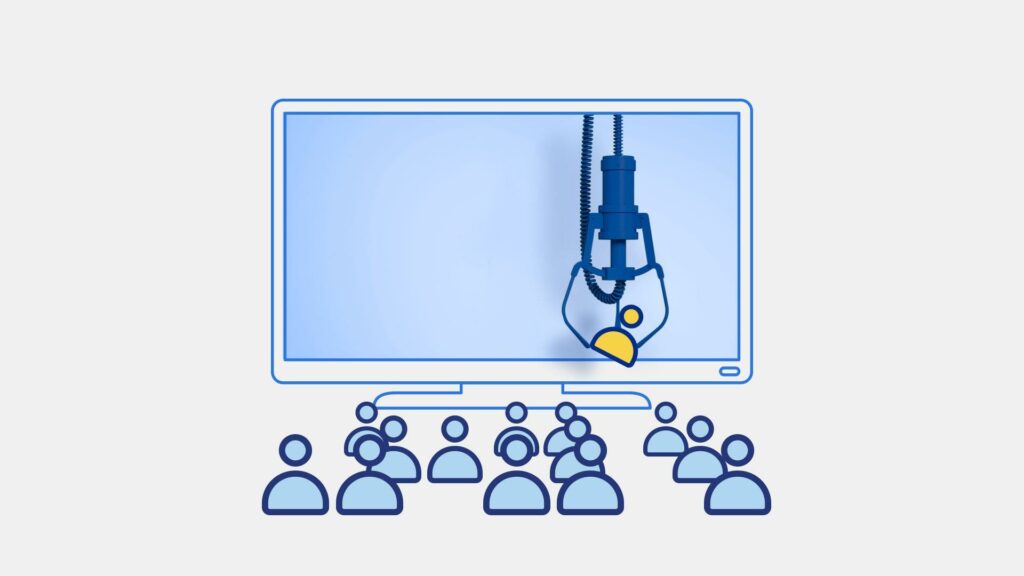

SSPs saw these open-market concerns as an opportunity to intervene and “curate the good stuff,” he explained.

Benefits involve dangers.

According to Kane, SSPs managing CTV inventory provide benefits such as expanded scale, protection from untrustworthy sellers, and pricing flexibility in programmatic auctions.

However, each of these advantages comes with a corresponding danger.

Jounce monitors around 50,000 CTV applications, but only a baker’s dozen of those apps are considered premium by most marketers and consumers, Kane said. That means SSPs should not include the vast majority of goods in curated packages that are only designed to include the good stuff, he said.

Furthermore, the quality of the long-tail media that SSPs incorporate in curated bundles can vary.

READ MORE: Telly Sees Social Budgets Coming Into CTV

According to Kane, Disney-owned ESPN, as well as Roku’s Sacred Sounds meditation channel, could be considered long tails. Kane believes that marketers who are more interested in ESPN than Sacred Sounds would benefit from purchasing ESPN straight from Disney rather than through a customized SSP package.

SSPs frequently incorporate inventory acquired from other SSPs in their curated bundles, so advertisers cannot be certain they are buying only from trustworthy sell-side partners.

Kane added that reselling is especially widespread in supply chains run by OEM equipment manufacturers. Many smart TVs and streaming devices that connect to TVs have a default free ad-supported television (FAST) channel, such as Samsung TV Plus, LG Channels, or the Roku Channel. He explained that these channels often act as massive ad networks, and customers should expect some resale.

While SSP auctions allow buyers to adjust bids to media quality, there is a catch: Buyers may end up spending heavily on bundles that comprise only some premium inventory.

According to Kane, some intermediaries explain their cut of CPMs by supplementing bids with audience data or adding artistic flourishes such as scannable QR codes, while others simply charge an unneeded fee.

So, what can purchasers do to adapt?

“Unfortunately, my recommendation is to deal with it,” Kane told reporters. “There’s a little bit of reselling that’s going to be part of most CTV auction packages.”

Buyers, on the other hand, can use their bargaining power to force SSPs to compete for ad expenditures by providing cleaner supply pathways, he said.

“Run head-to-head tests,” Kane advised. “Have them compete with each other on who can do the best job of curation, who can provide the most transparent reporting and who can secure inventory at the lowest prices.”

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.