Hello, Disney+ has advertising.

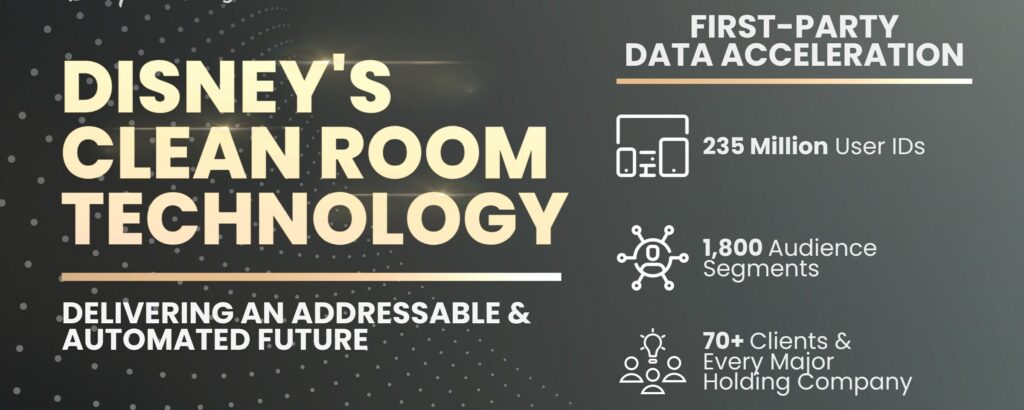

On Monday, Dana McGraw, SVP of data and measurement science, said that Disney’s audience graph and clean room technology will be offered in Latin America for the first time outside of the United States. The announcement comes ahead of Disney+’s launch this week, which will include commercials throughout Latin America.

Disney is leveraging its BridgeID audience identifier, which was officially announced last week at Cannes Lions, to assist LATAM advertisers match and target audiences across its inventory.

READ MORE: Disney Taps Into NBA Stars’ Minds To Promote ‘Inside Out 2’

Additionally, the LATAM Disney+ app will contain content from Star+, which includes ESPN sports, allowing marketers to purchase advertising across Disney inventory in one location. The revamp is similar to the new US app, which integrates Disney+ and Hulu (with the exception that Hulu remains a standalone app and Star+, which was only available in LATAM, is no longer available).

Disney is also collaborating with Mercado Libre, a LATAM shopping site and loyalty program that operates its own ad buying platform. This collaboration will enable brands to target and attribute ads on Disney+ based on ecommerce outcomes, such as retail and purchase data. Brands can also bid on these advertisements programmatically.

READ MORE: Bruce Springsteen Documentary Coming To Hulu And Disney+ In October

Disney officially unveiled BridgeID on Wednesday, although early versions have been available since 2022, when the studio partnered with The Trade Desk to adopt its UID 2.0 identification.

To match its data with UID2 IDs, Disney employs synthetic IDs, which are encrypted identifiers based on its audience graph that correspond to homes but contain no personally identifiable information. These IDs also change, so advertisers cannot create durable profiles. If an advertiser conducts a two-month campaign and uses Disney’s synthetic IDs to track reach and frequency, the IDs will be removed by the next campaign.

BridgeID is essentially a synthetic ID, although it can also operate with IDs other than UID2, according to McGraw.

BridgeID is also compatible with Yahoo’s ConnectID, LiveRamp’s RampID, and Experian LUID. McGraw believes Disney will be better positioned to build its streaming business globally if its audience graph is compatible with more identifiers, some of which have footprints in other markets or business categories.

READ MORE: Disney’s New ESPN Stand-Alone Streaming Service Will Come To Disney+ As A Bundled Live TV Service

She also emphasized that more data meant higher match rates.

Advertisers want more than just accurate and scaled ad campaigns; they want to achieve measurable sales.

This is where the new cooperation with Mercado Libre comes into play, according to Kattia Quintanilla, VP of Disney Advertising Sales in Latin America.

Disney expects an increase in demand from existing marketers looking to supplement their direct purchase with the studio with extra targeted data available programmatically, she said.

Disney also anticipates the arrival of more small and medium enterprises in the region that will use Mercado Libre’s self-service platform, she said. Previously, these advertisers lacked the local or particular audience targeting to justify a costly streaming campaign. A self-service platform, such as Mercado Libre, makes it easier and less expensive to test.

Disney, like almost every other TV network with a streaming service, is looking for methods to incorporate performance metrics into its streaming advertising. In May, Disney used Walmart Connect to gain access to the retailer’s shopper data, and earlier this month, it revealed numerous new shoppable ad formats.

According to McGraw, this expansion into LATAM is the next step in Disney’s strategy to grow its streaming business internationally. It would begin by “extending the data capabilities we have in the US [to] Latin America.”

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.