Industry professionals are typically well aware that the European CTV advertising business is extremely different from the US market and will not grow in precisely the same manner.

The amount of regional competitors, the language and regulatory obstacles prevalent in particular areas, and the particular TV ad trading structures found in some markets all provide special difficulties for expanding the European CTV ad market that does not exist in the US.

One distinction between the markets that receives little attention is the ways in which US and European audiences view advertising. Generally speaking, it’s thought that the two regions are somewhat comparable in this regard: people want ad-free programming but are willing to watch advertising in return for free or reduced TV.

READ MORE: GroupM Plans To Double Advertising Spending On Women’s Sports Programming

Major variations do exist, though, as recent study from RTL AdAlliance indicates. The third version of the yearly report The New Life of the Living Room, which tracks shifting TV watching patterns, has been released by the global sales firm. The poll included eleven European markets this year for the first time (Belgium, Denmark, Finland, France, Germany, Italy, The Netherlands, Norway, Spain, Sweden, and the UK). And the research indicates that, overall, US viewers are far more open to advertising in streaming services, which has ramifications for European broadcasters expanding their CTV offers.

‘Ad enough’ in Europe

The US and Europe are not very different on a lot of CTV penetration indicators.

Slightly higher than 78 percent in Europe, 81% of US respondents stated they own a smart TV. Comparatively to 68 percent in the US, 69 percent of those polled in Europe indicated they watch linear TV at least three times a week. Conversely, 77 percent of US respondents indicated they watch subscription video on-demand (SVOD) content at least three times a week, compared to 77 percent of European respondents.

AVOD and BVOD content consumption differs significantly, though. Comparing to just 25% in Europe, almost two thirds (62%) of individuals questioned in the US indicated they watch AVOD content at least three times a week.

READ MORE: This Year, CTV Will Generate $20 Billion In US Advertising Revenue

Part of the reason for this could be that the two areas have different tolerances to advertising. Comparatively speaking, half of all Europeans rated the advertising on linear TV as either four or five, compared to 32 percent of Americans. Comparable trends were seen for SVOD (45 percent in Europe, 36 percent in US), YouTube (57 percent in Europe, 38 percent in US), AVOD (41 percent in Europe, 30 percent in US), and BVOD (49 percent in Europe, 31 percent in US).

On linked TV, Europeans are less receptive to targeted advertising. In contrast to 32 percent in America who said “definitely” and 34 percent who said “probably” about targeted TV advertising, just eight percent said they are “definitely” receptive to them and 28 percent said they are “probably” open.

And Europeans, by their own estimation, are far less inclined to react to TV commercials. For instance, compared to 51 percent of Americans, just 19 percent of Europeans indicated they either frequently or occasionally purchase things after seeing them promoted on TV.

The European model

Even if this could present a negative image for ad-supported CTV advertising in Europe, it’s crucial to keep in mind that these views don’t always correspond with actions. For instance, while Europeans report being far more irritated by advertising on YouTube than they do on traditional TV, YouTube is not having trouble gaining viewers there.

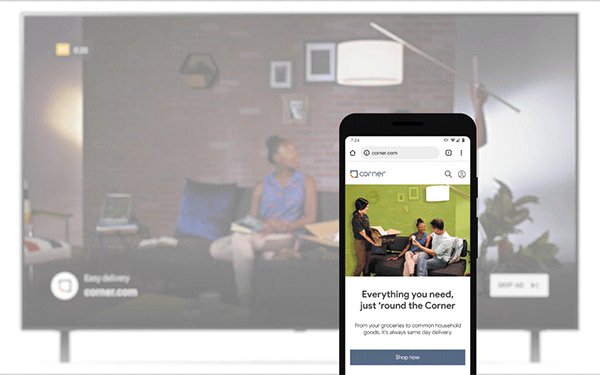

But for CTV services hoping to draw in and keep viewers, user experience with advertising is undoubtedly crucial. The research from RTL AdAlliance also indicates that US best practices might not apply to Europe.

Making advertisements more pertinent is one win-win that broadcasters frequently highlight and claim benefits both sponsors and viewers. According to RTL AdAlliance research, however, targeted TV advertising are not very popular in Europe.

Consequently, European broadcasters need to carefully consider how they build the CTV ad experience, including not only the total amount of ads but also the length and spacing of ad breaks. Pause advertisements and other less disruptive forms may also be even more crucial in Europe, as may any other changes that lessen viewers’ dislike of advertising.

Radiant TV, offering to elevate your entertainment game! Movies, TV series, exclusive interviews, music, and more—download now on various devices, including iPhones, Androids, smart TVs, Apple TV, Fire Stick, and more.